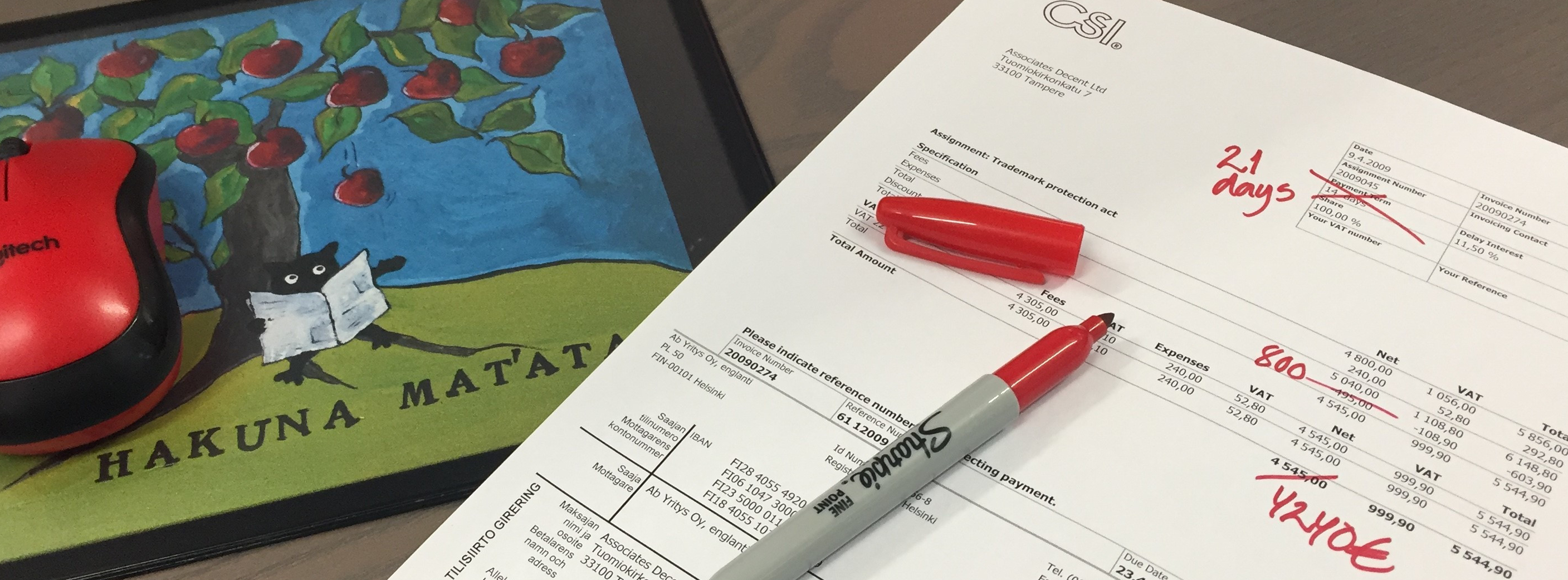

Even when the invoice content is verified carefully, an invoice that has already been sent to a customer may sometimes require changes. There is no general guidance on how to make such changes, so it has to be considered case by case. The starting point is always the need for change: do you need to move the due date, change the payer, or perhaps modify the transactions on the invoice?

Some changes are allowed even after invoice creation

Certain invoice information can be edited smoothly in CSI Lawyer even after the invoice has been created and sent, as long as this happens within the same accounting period. Such information includes, for example, the invoice date, due date, payment term, language, and the payer's contact information.

A forgotten discount can be provided as a partial credit

When an invoice is created, its transactions get the status “Invoiced” and can no longer be edited without cancelling the invoice first. Thus, any changes to invoiced transactions require a bit of creativity. If you have forgotten to add an agreed discount to the invoice, you can resolve the issue by making a partial credit for the invoice. In CSI Lawyer, the partial credit can be allocated to transactions and / or costs, and divided between them as you wish.

If nothing else works, cancel the invoice

Sometimes you notice only afterwards that the spelling of the invoiced transactions has to be corrected or that those transactions should have been invoiced through another assignment. In that case, your only option to edit transactions is to cancel the invoice. The cancellation action automatically creates a credit invoice in the background, which can be sent to the invoice payer, if required. In the bookkeeping reports, cancellation of the invoice reduces the sales during the accounting period for which the cancellation (= credit invoice) is registered.

As a rule of thumb, if you wish to re-invoice the transactions after editing them, you always have to cancel the invoice. In case you just credit the whole invoice, its transactions remain in the Invoiced status prohibiting their editing and re-invoicing.

When changing a payer, keep in mind the VAT treatment

When changing the payer of an invoice you first have to ensure that the new payer is subject to the same VAT treatment as the current one (for example that both belong to the EU community sales area). If the payer's VAT area remains the same, you can simply change the payer without cancelling the invoice. If the new payer belongs to a different VAT area, it is advisable to cancel the original invoice, replace the old payer with the new one in the assignment information, and then re-create the invoice. This way, both the payer and VAT information of the new invoice will be correctly registered in the bookkeeping reports.

For the above reasons, whenever you add a new payer to CSI Lawyer, it is crucial to register the correct VAT ID and home country for it. This ensures that CSI Lawyer adds the correct VAT to new invoices automatically.

What if the invoice that requires changes has already been paid?

In CSI Lawyer, a payment received is registered for the date it arrives in the company’s account. When the payment is adjusted to an invoice, the invoice gets the status Paid. If any subsequent changes are required to the invoice (such as a correction to the payment date or amount), the payment adjustment has to be cancelled first. After that, it is possible to make the required corrections to the payment entry, and then re-adjust it to the invoice.

In all payment-related changes it is important to pay attention to dates. If the fiscal period has already been closed, you may need to re-open it in order for the change to be reflected also in the bookkeeping. After that, you can make your accountant happy with new, up-to-date bookkeeping reports.

|

Jenni Nordman CSI Helsinki, Customer Relationship Manager Believes that financial management alway offers new things to learn, and those can be learnt by anyone having enthusiasm. |